top of page

Search

Comparing the tax benefits of an LLC (Limited Liability Company) to those of an S Corporation (S Corp)

When comparing the tax benefits of an LLC (Limited Liability Company) to those of an S Corporation (S Corp), there are several key factors to consider. Both structures offer unique tax advantages, and the best choice often depends on the specific circumstances of the business and its owners. Here’s a detailed comparison of their tax benefits: 1. Taxation Structure LLC: Pass-Through Taxation: By default, an LLC is treated as a pass-through entity for tax purposes. This means

Valerie C.

4 days ago3 min read

The difference in taxation of an S Corporation and a C Corporation?

The taxation of S Corporations and C Corporations differs significantly, impacting how corporate profits are taxed at both the entity and shareholder levels. Here’s a breakdown of the key differences: 1. Taxation Structure C Corporation: C Corporations are treated as separate legal entities for tax purposes. They must file a corporate tax return (Form 1120) and pay federal income taxes on their profits at the corporate tax rate. When C Corporations distribute profits to share

Valerie C.

4 days ago2 min read

What are the tax implications for a Single-Member LLC and a Multi-Member LLC

The tax implications for a Single-Member LLC and a Multi-Member LLC differ mainly in terms of taxation structure, filing requirements, and how profits and losses are reported. Here’s a clear breakdown of each: Single-Member LLC Tax Classification: A Single-Member LLC is treated as a "disregarded entity" for federal income tax purposes. This means the IRS does not recognize it as separate from its owner. Filing Requirements: The owner reports income and expenses from the LLC

Valerie C.

4 days ago2 min read

Understanding How Different Business Structures Are Taxed

When starting a business in the U.S., choosing the right structure—like an LLC, S Corporation, or C Corporation—can affect how your income is taxed. Here’s a breakdown of these categories to simplify the tax implications for each. 1. LLC (Limited Liability Company) Tax Classification: Single-Member LLC: Treated as part of the owner's tax return. The owner reports business income on their personal tax form (Form 1040). Multi-Member LLC: Generally taxed like a partnership unl

Valerie C.

4 days ago2 min read

Understanding Business Structures: LLC, Corporation, and S Corporation

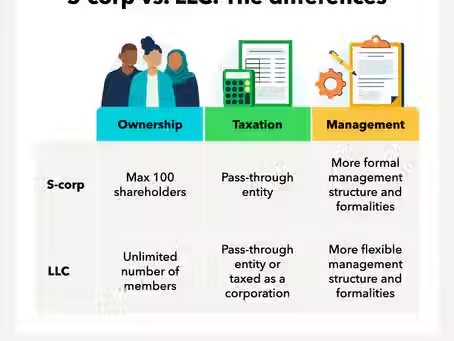

When you're thinking about opening a business, one of the first decisions you'll need to make is which legal structure to choose. Three of the most common types are Limited Liability Companies (LLCs), Corporations, and S Corporations. Each structure has its own advantages and disadvantages, especially regarding taxes and personal liability. Let’s break them down in simple terms. 1. Limited Liability Company (LLC) An LLC is a popular choice for many new business owners for se

Valerie C.

4 days ago3 min read

Services by Valeria's Structured Guide to Forming a Business in Florida (2026)

This updated guide outlines steps to form a business in Florida, incorporating 2026 state regulations, including filing fees, annual report requirements, and local licenses under Florida Statutes (Chapters 605 for LLCs, 607 for corporations, 621 for professional entities). It covers common structures: sole proprietorship/DBA , LLC , corporation (C-Corp or S-Corp) . LLCs remain most popular for flexibility and limited liability protection. Step 1: Decide on Business Structure

Valerie C.

6 days ago2 min read

Simplifying the 199A Deduction for Small Business Owners What You Should Know

Running a small business comes with many challenges, and one of the biggest is managing taxes. The 199A deduction, also known as the pass-through deduction, offers a valuable tax break for many small business owners. Yet, the rules can seem complicated and confusing. This post breaks down the 199A deduction into simple terms, explains recent improvements, and shows how you can benefit from it. What Is the Pass-Through Deduction? The pass-through deduction applies to businesse

Valerie C.

Nov 15, 20253 min read

Big Picture Tax Planning for Small Businesses in 2025

How LLCs, Partnerships, Sole Proprietors & Schedule C Filers Can Benefit — and Why Having a Trusted Accountant Matters If you’re a small-business owner — whether you operate as a sole proprietor, a partnership, or an LLC taxed as a pass-through entity — 2025 brings some significant tax-planning opportunities. At Services by Valeria, we specialise in concierge accounting services for small businesses (especially in construction), so you can focus on what you do best — and we t

Valerie C.

Nov 14, 20256 min read

Tax credit updates under the OBBBA

Under the One Big Beautiful Bill Act (OBBBA) enacted July 4, 2025, several changes benefit taxpayers who expect refunds due to having qualified dependents. The most impactful updates for 2025 are to the Child Tax Credit and the Adoption Credit, including expanded refundability and clarifications that can increase cash refunds for eligible families. Key dependent eligibility rules remain in place and must be met to claim these benefits. Child Tax Credit (CTC) updates for 2025

Valerie C.

Nov 12, 20253 min read

Here are three practical, real-world techniques small businesses can use to improve cash flow visibility

💡 1. Use Real-Time Cash Flow Tracking Tools What it is: Adopt accounting software or apps that sync directly with your bank accounts — like QuickBooks Online, Xero, or Wave — to automatically update your cash position every day. Why it helps: Gives you a live view of what’s coming in and going out. Helps spot dips before they happen so you can plan ahead (like delaying a purchase or collecting a payment sooner). Creates automatic reports that show trends over time. Pro Tip

Valerie C.

Nov 11, 20252 min read

Honrando a Nuestros Héroes: Apreciación del Día de los Veteranos de Services by Valeria

En Services by Valeria , estamos orgullosos de apoyar a los valientes hombres y mujeres que han servido a nuestro país. En este Día de los Veteranos, y todos los días, rendimos homenaje al valor, sacrificio y compromiso inquebrantable de quienes han defendido nuestras libertades. Su dedicación nos inspira. Sabemos que la vida después del servicio puede traer nuevos desafíos — desde adaptarse a la vida civil hasta manejar las finanzas personales. Por eso queremos expresar nues

Valerie C.

Nov 5, 20251 min read

Honoring Our Heroes: Veterans Day Appreciation from Services by Valeria

At Services by Valeria , we proudly stand with the brave men and women who have served our country. This Veterans Day, and every day, we honor the courage, sacrifice, and unwavering commitment of those who have defended our freedoms. Your dedication inspires us. We understand that life after service can bring new challenges — from adjusting to civilian life to managing personal finances. That’s why we want to show our gratitude in a meaningful way. 🎖️ Year-Round 15% Discount

Valerie C.

Nov 5, 20251 min read

Frequently Asked Questions BOI (Beneficial Ownership Reporting Law)

When Should my company report beneficial ownership information? On January 1, 2024, FinCEN launched the BOI E-Filing website to report...

Valerie C.

Jan 27, 202415 min read

Dos and Don'ts of Applying for IRS Penalty Reduction in 6 Steps!

Taxpayers hate paying IRS penalties. Unfortunately, most taxpayers who are fined by the IRS do not request relief or are denied relief...

Valerie C.

Apr 19, 20216 min read

Créditos Fiscales para Empleadores

Muchas empresas que se han visto gravemente afectadas por el coronavirus (COVID-19) calificarán para dos nuevos créditos fiscales para...

Valerie C.

Dec 30, 20203 min read

New Employer Tax Credits

Many businesses that have been severely impacted by coronavirus (COVID-19) will qualify for two new employer tax credits – the Credit for...

Valerie C.

Dec 30, 20203 min read

Valerie C.

Dec 30, 20200 min read

Cómo iniciar un negocio

Paso 1: Decidir sobre una estructura empresarial Hay 3 opciones básicas: un DBA, una corporación o una LLC. Un DBA o "Doing Business As"...

Valerie C.

Oct 7, 20205 min read

How to Start a Business

Step 1: Decide on a Business Structure There are 3 basic options: a DBA, a Corporation, or an LLC. A DBA or “Doing Business As” (also...

Valerie C.

Oct 7, 20204 min read

Información continua sobre los pagos de estímulo y cómo se desembolsarán a través de nuestros bancos

Como seguimiento de nuestro correo electrónico de ayer (15/04), es importante recordar que la gran mayoría de los contribuyentes,...

Valerie C.

Apr 16, 20202 min read

bottom of page